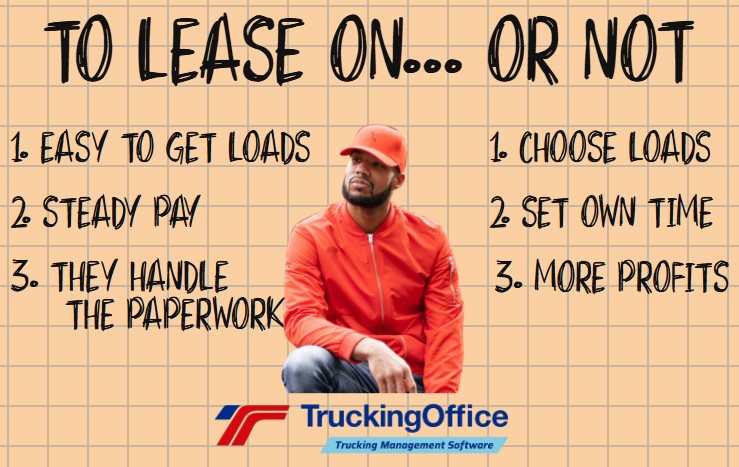

Should New Owner-Operators Lease On with a Trucking Company?

In a trucking career, probably the biggest event is purchasing the first rig. It can be a terrifying contract to sign when a five-year-old cab costs over $50,000 with a monthly loan payment of nearly $1000. Signing on to a trucking company sounds like a good idea.

Leasing On

Signing a contract with an established trucking company is called “leasing on.” It allows the trucker to haul loads under the authority of the trucking company while maintaining independent trucker status. Not an employee, but a contracted service professional with some autonomy, but without the paperwork.

Trucking Company Management

For a new owner-operator, the list of back-office chores is eye-opening. Most drivers don’t know about IFTA, IRP, HVUT, (just to name the taxes) or billing, DOT compliance, or maintenance logs. Their employer took care of those details. They were in charge of getting the load from point A to point B.

This isn’t a little hurdle. The learning curve in managing an independent driver trucking company is steep. Leasing on is the middle step in a trucking career. Often, it’s a good step to take.

Getting Loads

Bigger trucking companies have several in-house benefits. One of them is brand recognition. A trucking company with hundreds of trucks on the road daily is likely the first one a shipper will think of if they’re looking for transportation for their goods. Alternatively, they’ve got a broker on speed dial to arrange a trucker to show up to pick up and deliver the load.

Getting loads isn’t a little task. Compared to time on the road, getting a load accounts for less than 1% of work hours.

Bigger trucking companies have contracts with shippers, their own brokers, and the infrastructure to support drivers. That alone is a good reason to stick with a trucking company. The pressure of locating a new load, then creating a dispatch and routing, is a huge issue.

When there’s a loan payment for a truck, it’s too easy to take a load out of desperation. You have to know how much it costs per mile to haul freight to know which offers to take and what to turn down. Getting started without that number is dangerous.

Paperwork

For the leased on driver, the greatest benefit has to be the lack of paperwork. That doesn’t mean there isn’t any, but the majority of it isn’t the owner-operator’s responsibility.

We’re not talking only about invoices, but that’s first. If the bill isn’t sent, it won’t get paid. The driver’s receipts, the signed BOL, fuel purchases, maintenance records and DOT compliance records all have to be collected and stored to present on demand. Then there’s the taxes – IFTA, IRP, HVUT – that must be computed and paid.

For the new owner-operator, having those taken care of by the trucking company removes half the difficulties when getting started.

We recommend that anyone interested in becoming a long distance truck driver that they take a year to work as an employee. Hold off on buying that rig until they’re sure that the life on the road is what they want. That’s also why we recommend taking a year after buying the first rig and lease on to learn the business aspects.

Because not every company handles their leased on owner operators the same way.

Read the Contract

The contract will spell out the trucker’s responsibilities and the company’s responsibilities.

- Proper insurance,

- where maintenance will be done

- how to schedule it,

- what do to with an on-the-road emergency,

- if the driver has the right to decline a load.

All of these details need to be clear in the owner-operator’s mind before getting behind the wheel. Some contracts offer discounts on fuel, assistance with insurance policies, and bonuses upon signing.

Paychecks

Leasing on can mean more predictable pay – not at the mercy of the accounts payable department of a shipper. The trucking company handles those late payments. A regular settlement schedule is very attractive when loan payments are staring at cash flow problems.

Cash flow and budgeting aren’t skills that come naturally to most people. Learning how to manage the profits and expenses of a trucking company needs experience.

That’s why we suggest that if you choose to lease on to a big trucking company, consider running your own set of books at the same time. Using a low-cost trucking management software like TruckingOffice PRO will keep track of the expenses, the cash flow, and help an owner-operator find their cost per mile. Using TruckingOffice PRO to compute Trucker Stats™ will show what loads make the most profit and if a lane is making money – or losing it.

In our next post, we’ll talk about the concerns an owner-operator should consider before signing a contract to lease on to a trucking company.

Recent Comments